Oil, often referred to as ‘black gold’, has historically had a profound impact on the global economy. Its original use in ancient civilisation was for medicine and lighting. However in the 19th century, it became the lifeblood of industrialisation, powering machinery, transportation and ultimately shaping geopolitics. Today, oil remains a critical driver of the global economy. As the world becomes more environmentally oriented (coupled with other factors such as geopolitics and supply), the demand for oil is expected to decrease. So how do countries dependant on oil for their economy evolve their economies?

Oil has exhibited a long history of volatility, characterised by dramatic price changes with profound global consequences, particularly in the 20th and 21st centuries. This volatility can be attributed to various factors, including geopolitical conflicts, supply and demand dynamics, and economic fluctuations. The oil embargo of 1973, triggered by political tensions in the Middle East, led to soaring prices and energy crises in Western countries, altering the global economic landscape. Similarly, the 2008 global financial crisis saw oil prices plummet from record highs, highlighting its sensitivity to economic downturns. Its historical volatility underlines the critical role oil plays in our globalised world by disturbing the governments of oil exporting countries and those reliant on it for their economy. These shocks are often inflationary, leading central banks to raise the base rate to limit the increased prices. This potential damage has encouraged governments to focus on energy diversification and sustainability for a more stable future.

The graph below illustrates this immense volatility over approximately 150 years.

Emerging economies such as India (4.5 million barrels of oil daily), China (11.7 million) and Brazil (3 million) are among the top 10 global consumers of oil and are developing towards tertiary sector shift from manufacture. However the US and Japan seem to be outliers. The US remains to be the sole largest producer and consumer of oil (19 million barrels daily). This is can be credited to its large transportation industry (accounting for 67% of total consumption) and, similarly to Japan, high energy demands being heavily industrialised with the world’s third-largest population. These developing economies are significantly dependent on oil, however this isn’t the case with many developed economies.

In an age of environmentalism, the use of oil and fossil fuels for energy is often frowned upon. Since the demand for oil is currently relatively high, it is difficult to project how this may change. More countries have begun to increase investment in renewable energy sources to mitigate the effects of global warming such as the UK in offshore wind farms as it plans to power all homes with this by 2030 (though this is only a target). However most of these countries are ‘deindustrialising’, having already undergone an industrial revolution and are moving towards a technology/service based economy, reducing oil usage as factories close. Other nations that have made significant strides in the use of renewable energy are Costa Rica, Morocco (which harnesses its abundance of sunlight for solar power), Iceland, and Sweden – which achieved its goal of 50% of its power coming from renewable sources eight years prior than expected.

Regardless, some states, especially in the Middle East and Nigeria, remain heavily reliant on the trade of oil and associated products for their economy and some are looking to migrate away from this dependency. These countries face a significant challenge in transitioning away from this dependency. To successfully migrate, adopting a multifaceted approach is beneficial. Firstly, diversifying their economic base is crucial. Governments could increase investment in sectors like renewable energy and technology to create new employment opportunities and revenue streams. Simultaneously, they could promote innovation and entrepreneurship to foster a culture of economic dynamism. Secondly, investing in education and vocational training programs can help develop a skilled workforce capable of participating in these emerging industries. Additionally, fiscal reforms, such as subsidising renewable energy, can reduce reliance on oil revenues, while simultaneously implementing policies to attract foreign investment, such as reduced tariffs, can stimulate economic growth. Finally, countries could prioritise environmental sustainability by transitioning to cleaner energy sources and implementing stringent regulations to reduce carbon emissions. Collaboration with international organisations and neighbouring nations can also provide valuable resources and support for a smoother transition.

While most of these policy reforms can be successfully implemented for emerging economies such as Nigeria, the matter is more complex for high income oil based countries such as Saudi Arabia, another country that plans to migrate away from oil dependency for their economy. The country partnered with McKinsey, a global management consulting firm, in 2015 to develop a roadmap for its migration away from an oil-centric economy. The strategy states that although Saudi Arabia saw much prosperity between 2003 and 2013 with an oil price boom (rising to the 19th largest economy, doubling GDP, household income rising by 75%, and 1.7 million new jobs), its economy can no longer grow purely based on oil revenue. Its productivity was measured to lag behind emerging economies and without any proper planning, Saudi would experience unprecedented rates of unemployment, fall in household income and the fiscal position of the government would deteriorate. To combat this, McKinsey have announced that a more market-based approach is required rather than the current government-led economic model. Ways of enacting this are greater workforce participation of both Saudi men and women; better business regulation; more openness to competition, trade and investment; taxation and higher domestic energy prices. These reforms aim to catalyse a sector shift to a technology/service based economy deemed to be more stable. Accrued benefits from this program include doubling current GDP and creating six million new jobs by 2030. While this plan seems sound in theory, only time will tell if it succeeds. Since 2015, Saudi Arabia have cut oil production and attracted private investment in other sectors to reduce dependency. As of this year (according to the International Monetary Fund), the country’s GDP growth is set to halve to 3.1% but this is still higher than the 2.6% growth rate predicted in January 2023.

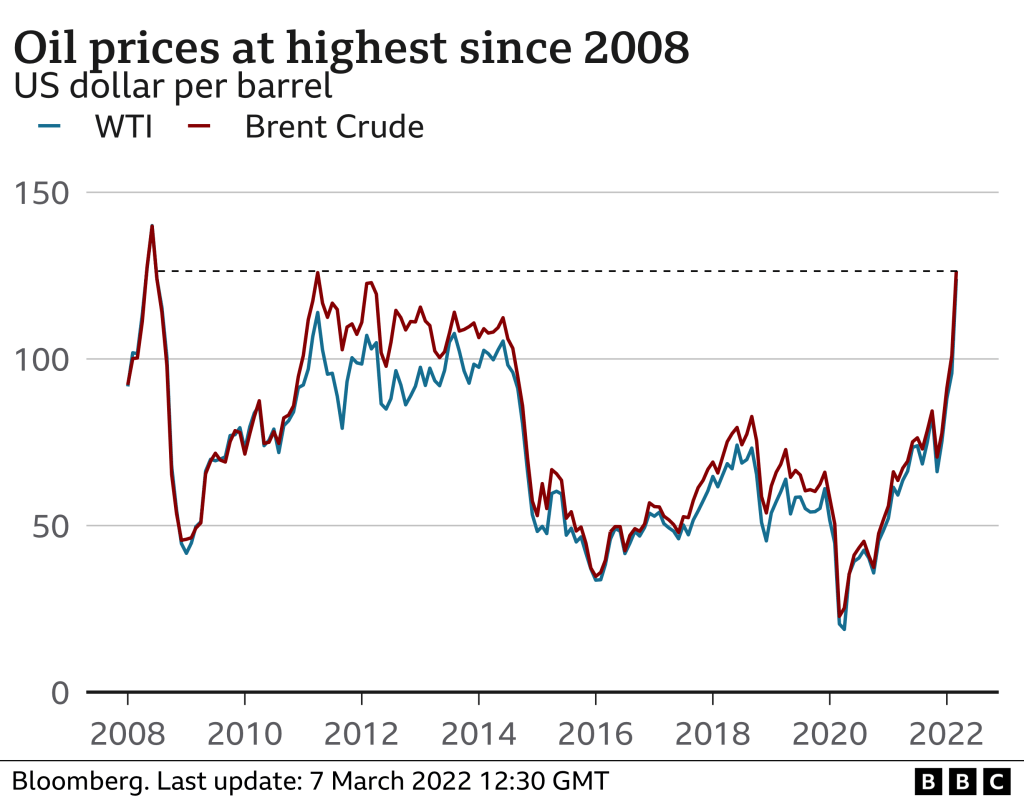

The conflict between Russia and Ukraine has had a substantial impact on world oil prices and energy use as well (being a key factor in the UK’s cost of living crisis and the only reason why energy prices skyrocketed). Energy markets were rocked as the battle intensified by worries that Russia, one of the biggest producers of oil and gas, may disrupt energy supply. Oil prices rose as a result of these worries, raising prices for individuals and businesses around the world coupled with Russian supply cuts as they refused to sell to Europe. As a result of the crisis, countries that depend significantly on Russian energy have become more aware of their vulnerability and are looking for ways to diversify their economies and decrease their dependency on Russian resources. The conflict serves as a sobering reminder of the complicated geopolitical issues that can affect the security of the energy supply and the pressing need for countries to build more robust and sustainable energy infrastructures. The graph below illustrates the staggering effect of the Russia-Ukraine war on oil prices, revealing that it has never been this high since the Great Financial Crisis of 2008.

Oil continues to be a key factor in determining the economic landscape of many countries and affecting international relations despite being a limited and volatile resource. With regards to everything from energy costs and trade balances to geopolitical stability and environmental sustainability, the dependence on oil has broad-ranging effects. It is obvious that the world must carefully negotiate the intricate web of oil dependency in order to achieve a more sustainable and resilient economic future in the face of rising problems like climate change and the switch to renewable energy sources. While this reliance is still very much a part of our global economic system, diversification and creative thinking are essential to reduce the dangers associated with this valuable resource and pave the way for a more prosperous and balanced future.

Mind blowing!

LikeLike