Coffee has become an indispensable drink throughout the world – over 2.25 billion cups of coffee are consumed across the globe every day. The coffee industry provides tens of millions of jobs for many, from manufacturing and producing the coffee and coffee beans, over 90% of which takes place in developing countries in regions such as South America, to selling the coffee in stores. In the UK alone, coffee supports over 200,000 jobs and the consumption of coffee in offices is worth £222m. Being a major export commodity, and being estimated to have a CAGR (Compound Annual Growth Rate) of 4.72% from 2023 to 2030 globally (the CAGR in the UK is 6.59% until 2028), it is clear that coffee has a significant effect on our national and international economies. This article explores in detail the effect of coffee on economies, examines the market and economics of coffee, and looks at some potential problems the industry faces and may face in the future.

Production and Geography of Coffee

In order to understand the coffee market properly, it is necessary to look at where the main sources of coffee are and the different types that are often sold. It is estimated that over 100 million people make a living through growing coffee, and certain developing countries have found economic success from it. For example, in 2009 and 2011, Brazil was the largest producer of green coffee, producing 2.7 million metric tons of it in one year, and, even now, Brazil produces 40% of the world’s coffee. There are two main markets where most coffee is sourced: Arabica, based in New York, and Robusta, based in London. Arabica is the most popular one, and is used by franchises like Starbucks and drink brands like Yuban. However, Arabica coffee is specifically grown in areas of high altitude (1.3-1.5km) with an annual rainfall of 50-80 inches, in order to retain a high quality, and to ensure consistency across all of its coffee. This means countries such as Ethiopia, which have a climate that is good for growing coffee, can greatly benefit from the business and economic growth that coffee production provides.

It is important to distinguish between commodity and specialty coffee – coffee is a complex drink with lots of variety, so it doesn’t easily lend itself to being a commodity. Commodities are meant to be uniform and interchangeable, meaning that you can’t express variety without hindering the commodity trade and production efficiency, or market price. Hence, there are generally two different types of coffee sold in the market:

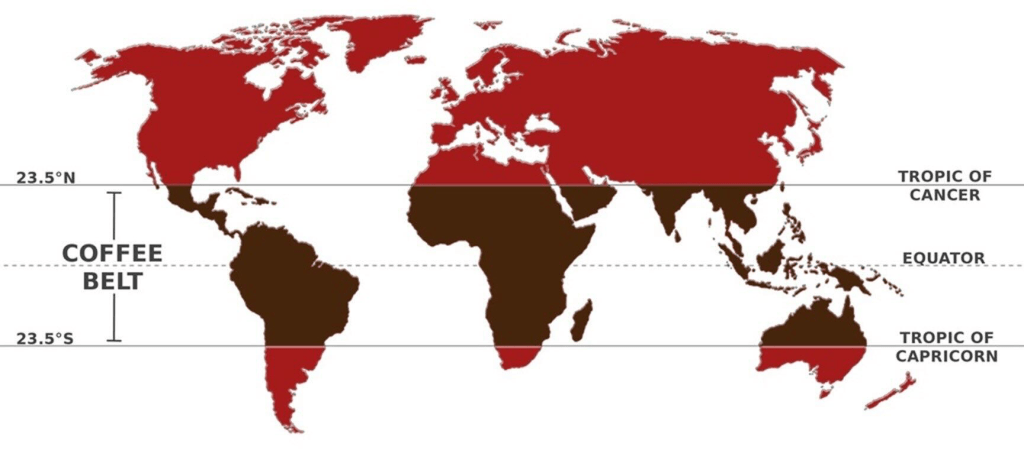

Commodity coffee is cheap. Generally, any two boxes of this coffee will be of a similar quality and command the same price. It is often sold in large quantities, and disregards the nuanced qualities and variety of coffee, meaning it is the type of coffee often used for making instant coffee, for example. Specialty coffee is perhaps more luxurious, and would be found in coffee shops and franchises in order to provide for the customer’s need of variety. In terms of production of coffee, as specialty coffee is of a higher quality than commodity coffee, it is naturally sold in less quantity as it is more difficult to produce. Nonetheless, countries and local economies can benefit from the growth of both commodity and specialty coffee, and profit from both the large production of lower-cost coffee, and the smaller production of higher-cost coffee. There tends to be a small selection of countries producing most of the world’s coffee, with only 3 countries – Brazil, Vietnam, and Columbia – producing 70% of coffee worldwide. These countries are inside what is known as the ‘Bean Belt’ – a group of countries near the equator which have the right conditions (altitude, rainfall, heat) to grow the coffee that companies like Arabica are looking for.

Map of the bean belt – countries between Tropic of Cancer and Tropic of Capricorn where coffee production is highest. – Operant Coffee

The structure of the Coffee Market

One of the most important indicators of the economics of coffee is the C-price (centrals price), which tells you the going rate for a shipment of commodity Arabica beans on the Intercontinental exchange (or ICE). Most commodity coffee is traded on the ICE as futures contracts, which are contracts that commit a buyer and a seller to trade a specific amount of coffee, for a predetermined price, at a future date. However, the futures market isn’t only used for trading physical coffee beans (although this is a big part of it). It also serves 3 other important functions:

- The C-price – The C-price on the ICE is often used as a benchmark for the rest of the industry, to determine a floor price, or a fair price, for their coffee. Hence, the C-price is a highly important metric for interpreting the economy of the coffee market.

- Risk Management – With the coffee market being so unstable, futures contracts allow traders to mitigate some of this risk by having a fixed price set for the future which won’t change with the market. Thus, by locking-in a price early, it makes traders less vulnerable to any fluctuations which may affect their supply.

- Speculation – Coffee futures and options are popular with day-traders and hedge funds, who hope to turn a profit by analysing the changes in price. However, frequent trading and speculating on the market can increase the volatility of it too. Because of the large amount of speculation, most of the trades on the market don’t end in the delivery of real coffee beans, and, in Arabica futures, 7 times more coffee is traded than is actually produced.

Market Fluctuations

The price of coffee is very volatile, and sees a lot of movement. This is less due to the demand of coffee, as it is an incredibly popular drink in most circumstances, and mostly because of supply factors. In the different stages of growing coffee, from planting the trees to the growth of coffee cherries, lots can go wrong. Once planted, a coffee tree takes 4 years to grow the beans, meaning the supply of coffee is inelastic in the short run. However, many of the large fluctuations we see in the price of coffee come from environmental factors that directly affect the supply.

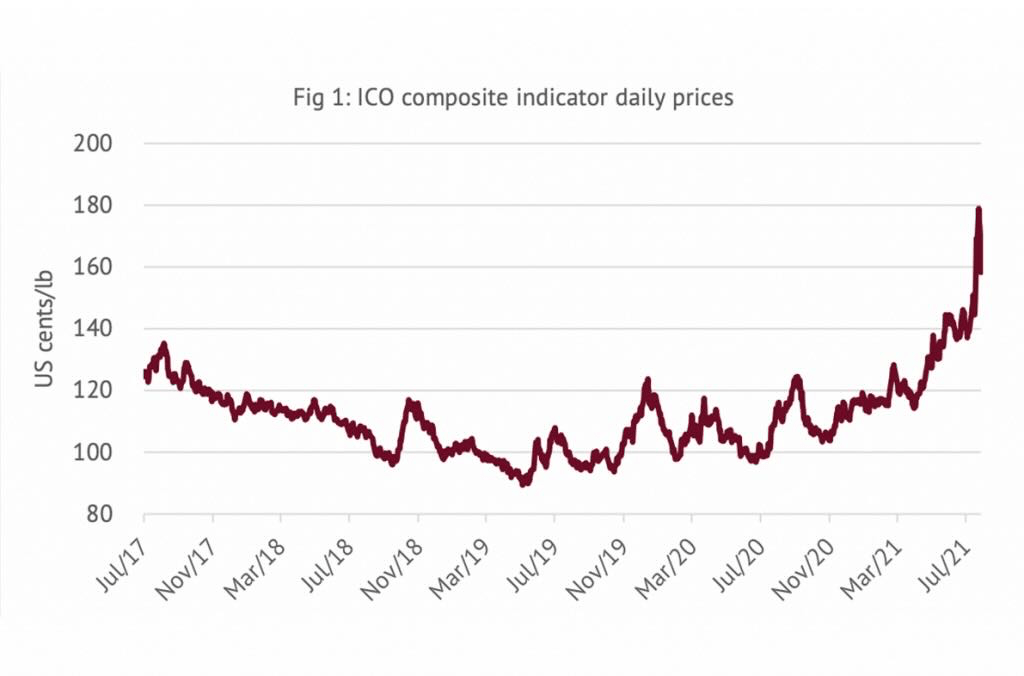

The world’s dependence on a small selection of countries, especially high for Brazil, means that the market could see unexpected fluctuations due to the growing conditions of the country at the time. For example, in July of 1975, Brazil experienced a surprising phenomenon – The Black Frost. It started to snow in the city of Paraña, which very rarely happened. Temperatures rapidly dropped, leading to the worst harvest Brazil had had in the century, and over 1.5 billion coffee trees were dead. This had a great impact on the market of coffee, as the trees took years to replace and left the global supply of coffee greatly diminished. Frosts have caused many price spikes, including one in Brazil in 2022 which caused the price of coffee to almost double in just a year.

Graph of coffee prices from July 2017, showing spike in prices due to Brazil frosts in 2021. – Global Coffee Report

Problems like drought, which ruins crops, and irregular rain, which means coffee doesn’t grow as efficiently due to its reliance on regular rain cycles, have also caused many fluctuations in price. Disease can also devastate crop yield, such as coffee leaf rust (a fungus which Arabica beans are specifically prone to), causing harm in places like Central America.

The Future of Coffee

Both the supply and demand of coffee have seen recent changes and trends. The demand of coffee has started to increase globally, and surprisingly, places like China (which primarily drinks tea) have seen increases of 10% per year in supply. As for supply, climate change certainly provides a problem, as increasing temperatures bring new diseases and pests which farmers are not used to dealing with. However, botanists are experimenting with more adaptable coffee variants which can thrive in these new and difficult situations. Promising developments have been made, like Liberica, which has combined the best parts of Arabica and Robusta for a new plant. In terms of prices, as climate change leads to unstable environments, this uncertainty can cause increased volatility in the market, due to unpredictable droughts and weather events which may affect harvest.