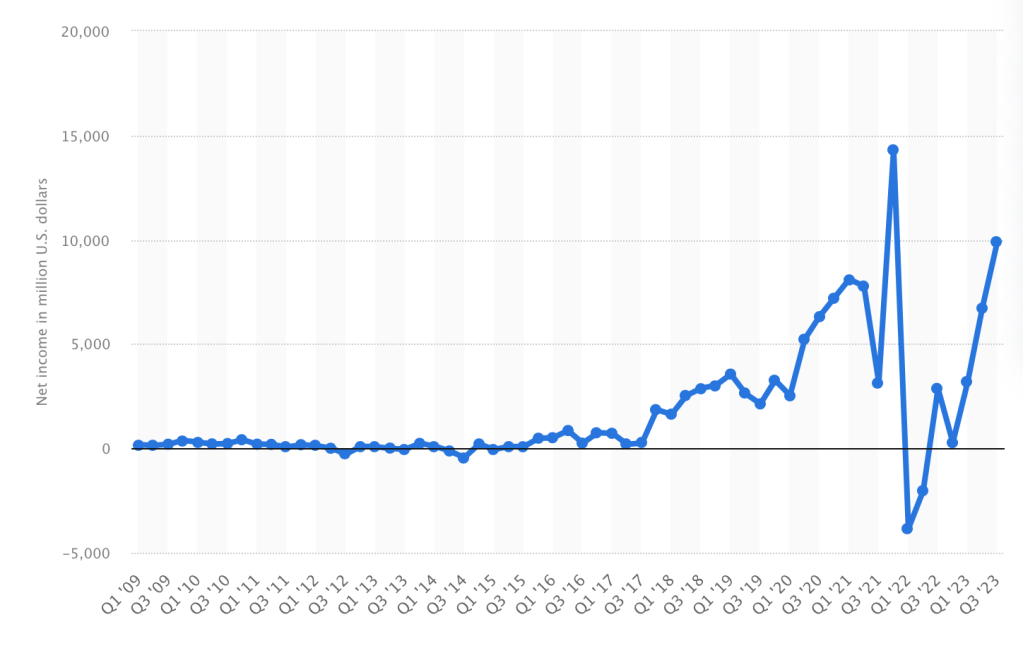

Amazon was founded on July 5, 1994 by Jeff Bezos from his garage in Bellevue, Washington. The company originally started out as an online marketplace for books. However, it has quickly grown into the largest online shopping site globally now worth about $1.75 trillion. In 2023, Amazon made $575 billion through global retail sales. Despite this massive amount of revenue generated on a yearly basis, only in the last few years has Amazon started making substantial profits. But how is it that a dominant, rapidly growing company worth trillions of dollars has taken so long before finally raking in some profit? To answer this question, it is first necessary to analyse their business model.

When asked what Amazon is, one would be forgiven for suggesting that it is simply an online retailer where an item is bought which then appears on your doorstep a few days later. Surprisingly, retail only comprises a small part of Amazon’s business canvas. Indeed, Amazon’s total retail operations in the US only make up about half of Amazon’s total revenue. This can be explained by the company’s strategy of competing on price and convenience resulting in slim margins on sales, expensive priority shipping and logistics operations to get packages to customers fast. In fact, most surprisingly, Amazon is losing money on its international retail operations. But why would a company ever do this?

Amazon is also a cloud computing company, as it owns Amazon Web Services (AWS). AWS is a catch for all of the various cloud services Amazon provides (e.g. allows businesses to store information to the cloud and deliver content). In 2023, AWS generated $91 billion in revenue. Cloud services have high margins and scales well, thus generating over $25 billion of operating income that year. Amazon is also involved in the digital advertising space, with Amazon Ads having made just under $50 billion in revenue in 2023. Amazon Ads grew by over 27% from 2022. Furthermore, Amazon generates money through subscriptions such as Amazon Prime, enabling them to make even more profit. So where is all this profit going?

Simply put, Amazon is a bundle of various businesses with some making very large profits and others making losses offsetting these profits. The businesses listed above are only the largest ones, yet there are many other much smaller businesses. Many of these smaller business lose money due to their lack of maturity (a measure of how well-established within an industry a business is). Money from more profitable businesses, instead of being collected, is reinvested into these smaller businesses in order to build up an initial infrastructure from which they can eventually begin to profit from. This process is illustrated by the image below. Notice how there are no outward arrows labelled profits.

But why was Amazon neglecting the need to generate profits for their first twenty years? Quite simply, Amazon are in the industry of breaking into new industries. Specifically, industries with high barriers to entry (i.e. markets that are extremely hard to break into). For example, a company in an industry with high barriers to entry would be Walmart. Walmart is a mass market retailer and has invested billions of dollars into their locations, marketing, capital and other necessities, in order to offer attractive options to customers. Walmart’s outlets usually turn in a 1 – 3% profit once all these investments are considered. If a new company was to attempt to break into the industry, they would lack the supporting and pre-existing infrastructure only available with billions of dollars of investment. This would mean that their items would be brought to market at a price likely 10 – 15% higher than the products at Walmart. Indeed, why would anyone buy the same item for a higher price from a random store with no established reputation? Even if a new entrant into the market lowered their prices, they would not be able to get lower than the 1-3% in returns resulting in a net loss. This shows that this market is nearly impossible to break into.

However, this is generally only applicable for a new company with insufficient funds. In the case of Amazon, it has the luxury of being able to suffer losses in the short term in order to build up market infrastructure and expertise which will ultimately make them more profitable in the long term, allowing them to lower prices as much as needed to outprice competitors to a point where they can no longer make enough revenue to stay afloat. Moreover, they have funds which they can pull from profitable parts of the company to make the necessary investments in order to succeed in other high-barrier industries. As Amazon break into these markets, their businesses grow until they have several successful, profitable businesses and a vastly scalable empire.