Protectionist policies are typically exercised by countries in order to protect domestic industries from foreign competition. Protectionism is usually expressed in the form of tariffs on foreign imports, subsidies, regulatory blocks and import quotas, alongside other restrictions placed on foreign trans-national corporations.

Governments often implement protectionist measures in order to protect domestic industries and firms. This is especially true when there are levels of high unemployment and foreign companies are dumping. This is when they export a product at a price that is lower in the foreign importing market than the price in the exporter’s domestic market. Smaller-scale domestic firms cannot compete due to economies of scale and higher factor costs, illustrating their greater inefficiency. One of the primary objectives to protectionism is that domestic firms generally lack incentives to grow. Thus, the government overcomes these incentive barriers by subsidising domestic industries, raising import tariffs and encouraging investment. Raising import tariffs also generates more revenue for the government. Moreover, there is an increased demand for domestic products because foreign goods are much more expensive. All these reasons spur domestic firms to develop. In the short term, this leads to higher employment in domestic industries and local businesses flourish. This results in a multiplier effect because more investment is likely to be put into these areas, from the local government and other large domestic firms, due to the thriving local businesses. This could be seen in India, although to a lesser extent today, where the US trade department say that India have the highest tariffs “of any major world economy”, which is at 13.8% on average in order to encourage the growth of its iron, steel and textile industries. India aggressively repelled foreign direct investment yet there was nevertheless a variety of industries, businesses and jobs. This has changed since the 1990s however, when India were forced to seek help from the IMF (due to the 1991 Indian economic crisis) who made them remove trade barriers, liberalising India’s young people by connecting their jobs with the rest of the world – such as the now booming Indian IT sector. Overall, although protectionism can be used to raise employment and develop local industries, countries are forced to engage in the free market at a later stage in their development.

At a wider level, we have seen how free trade measures help domestic firms because they are no longer competing with large TNCs. Although this may seem like a good thing, protectionism is often thought to create an artificial scarcity within countries – where the lack of competition drives domestic firms to become complacent, since they no longer need to compete with highly efficient TNCs. Such artificial scarcity and complacency raises prices and gives consumers less choice, reducing consumer welfare and spending. This is detrimental to a country’s economy and severely affects the poorest in society – who can now afford even less than they could before and as a result are the most vulnerable to inflation. Prices also rise because the prices of cheaper goods from TNCs are raised. Even on a long-term scale, when governments allow (greater) free trade, these domestic firms are washed out since they can no longer compete with TNCs in their own and other countries. In the long term, countries have to protect their domestic firms, leading to economic nationalism.

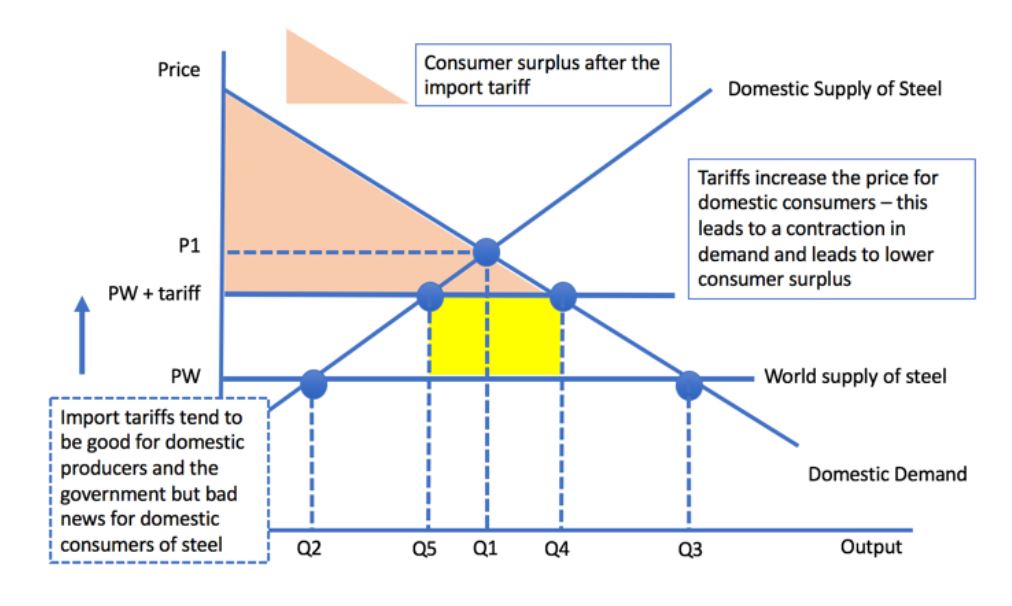

This diagram illustrates how consumer welfare and spending decreases as a result of import tariffs (a protectionist measure), by using steel as the product and comparing the domestic supply and demand over time.

Another fear that protectionist measures bring is that of retaliation from other countries. More specifically, countries that retaliate are often larger, more developed nations who have the resources to do so. When one country imposes a tariff on a specific industry from a specific country, the other is likely to take retaliatory action and increase their own tariffs on the original country’s industries. This is because countries never want to be at loss from a trade deal, and is in their best interests to be the ones gaining from the agreement. This is due to the domestic bureaucratic incentives to placate their own supporter base. Moreover, tariffs can also be used as negotiating chips in deals and agreements. However, this retaliatory action often spirals into a trade war. One such trade war to focus on is the US-China trade war. China, who are able to produce goods at a much lower cost due to a lower standard of living and an exchange rate fixed to the dollar, sell many goods to US citizens. Moreover, manufacturing jobs in the US have declined by 27% since 1998. Therefore, President Trump, to encourage the growth of more jobs in the US, raised import tariffs from China. One such raise was over steel prices – which were heighted by a 25% import tariff. This protectionist measure led to retaliatory actions from China, which in turn raised the tariffs on soybeans (one of their biggest imports) from the US. This spiralling trade war also affected other uninvolved countries, where the cost of money fell and the European Central Bank cut its deposit rate to a record low of -0.5%. This is an example of how retaliation leads to a negative multiplier effect, decreasing exports and thus global free trade.

One such industry that is pivotal to many protectionist measures is the defence sector. This is because if a country relies on another for imported arms and training, they can leave themselves vulnerable, and in essence, become a puppet of the other. From 2002 – 2016, the US sold $25.8 billion worth of weapons to Saudi Arabia – their largest customer. Not only does this mean that Saudi Arabia were reliant upon US technology to defend themselves, they also had to receive training from US soldiers in how to use and operate the technology. This allows the US to indirectly remain a strong military presence in the Persian Gulf, and receive a stable supply of oil in a largely unstable global oil market. Saudi Arabia also receives protection from the world’s largest superpower at a time where they are threatened by Iran and are fighting a war in Yemen. However, it is now very difficult for Saudi Arabia to gain independence from the US, as it would mean having to develop new weapons and retrain their soldiers – which would take a lot of time (leaving them vulnerable to attack) and resources. This raises an important question: to what extent should a country protect its defence sector in order to gain military independence but potentially miss a trade and political ally? In today’s climate, I think it is vital for most countries to exercise some form of independence in the event of rising political tensions. This weigh up between independence and quickened development is difficult for many countries; usually their judgement is clouded by the short-term economic gain that a trade ally (and cheaper arms) brings. This is especially true when governments primarily care about short-term development in order to gain votes and stay in power for the next term.

Overall, protectionism is useful to generate revenue for the government, raise employment and develop local industries. However, this short-term gain is outweighed by the reduced consumer choice and welfare, inefficiency in the long term and the retaliation from more developed countries. Thus, protectionism is only beneficial in specific industries, such as the defence sector.