House Prices are Falling

The UK’s current housing market might shock much of the British population, as high interest rates have led to house prices being down 3% nominally and 11% accounting for inflation since their peak in August 2022. (Bloomberg UK, 2023) However, this surprise is understandable as UK house prices have been a one-way bet for a long time, consistently rising since 2012, if the artificial fall in prices caused by the COVID-19 pandemic is disregarded. Nevertheless, this sudden change could have devastating effects on the economy and the impact of the housing market cannot be understated given how the value of UK housing stands at £8.6 trillion, more than triple the nation’s GDP of £2.6 trillion, and worth 36% of household wealth. (Economics Help, 2023)

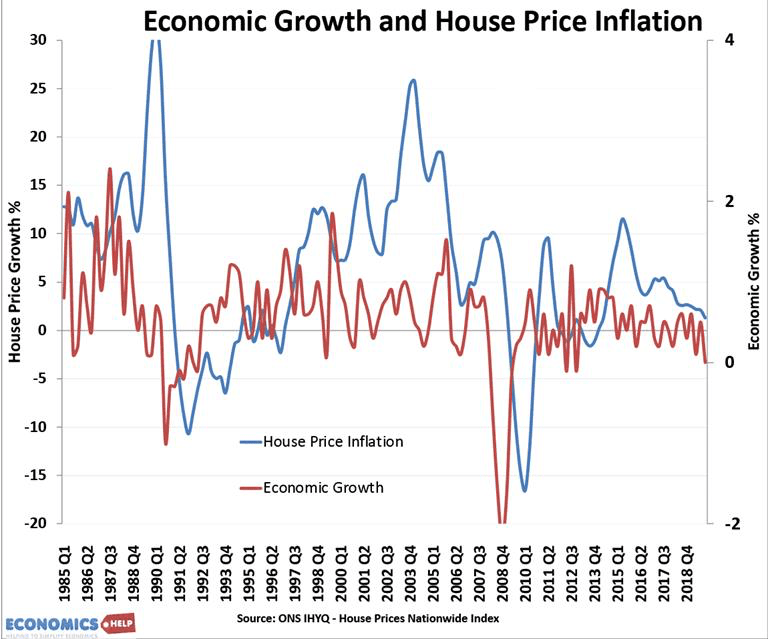

From past recessions, it is clear there is a strong correlation between the housing market and a nation’s economy. In fact, 9 out of the past 11 American recessions were preceded by turbulence in the housing market. More specifically, two of the most recent recessions, in 1991 and in 2007/08, seem to have been partially caused by house price drops.

Harms to the UK economy

The main issue with falling house prices is its impact on consumer spending. Homeowners lose significant value on their biggest asset, their property, making them lose confidence, leading to less spending and more saving. Since consumer spending is crucial to keeping the economy afloat, falling house prices cause a fall in GDP and lead to prices decreasing further in a vicious cycle. Furthermore, when the value of a property falls below the price a homeowner paid for it, households get trapped in ‘negative equity’ (a deficit of owner’s equity, occurring when the value of an asset used to secure a loan is less than the outstanding balance on the loan), and they become highly incentivized to save, since they need to make up for the money they are losing. By decreasing how much money is spent, economic growth stagnates (and possibly even regresses).

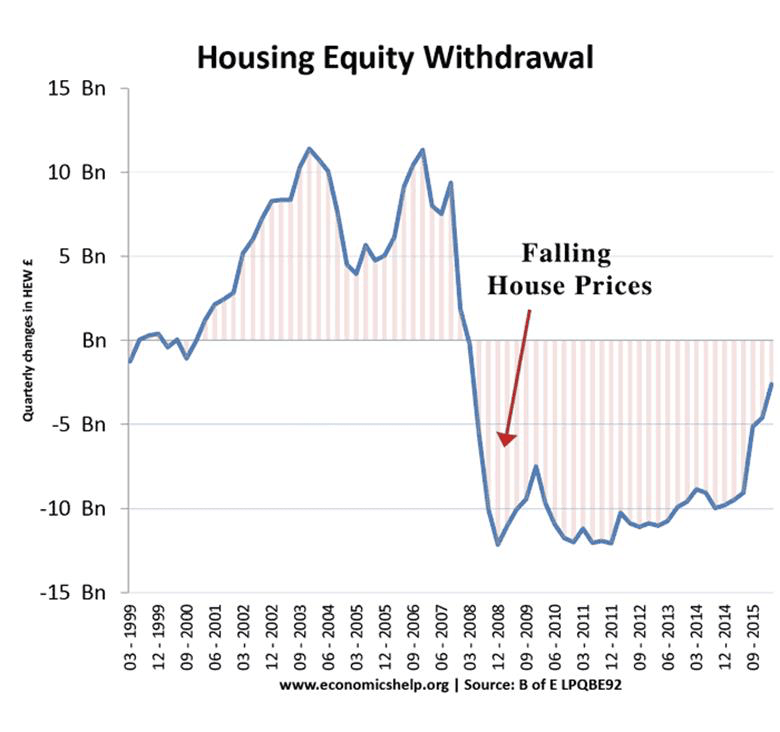

Normally, rising house prices allow owners to re-mortgage their houses and take out an equity withdrawal, enabling more spending. This method led to an extra £11 billion being put into the UK economy before the financial crash of 2007/08, but after it, equity withdrawal was -£12 billion. In other words, people began saving money to pay off their mortgages early. Therefore, with decreasing prices and increasing mortgage rates, the economy is harmed due to hindered spending.

Rising mortgage rates, which apply to 53% of homeowners, cause further problems. (Bank of England, 2020) UK mortgage rates have slowly been increasing due to rising interest rates and were propelled upwards when Liz Truss and Kwasi Kwarteng threw the UK bond market into chaos through their “mini” budget. Richard Donnell, the executive director of research at online property portal Zoopla stated, “The mini budget added a whole percentage point onto mortgage rates.” (CNN Business, 2022) This is likely a result of citizens lacking faith in the UK’s ability to finance its budget, which created less demand for UK government bonds, driving down their prices and increasing their interest rates. Government bonds are the benchmark for all other bonds, since they are seen as being the least risky, so loan interests increased in every sector.

This means the average homeowner must pay £500 more each month to pay off their mortgage, leading some to spend thousands on refinancing out of fear of ever-increasing rates. As it is quite possible 4% to 5% will become the new norm for mortgage rates, as opposed to past rates below 2%, it is expected that up to 1.8 million UK borrowers will need to refinance soon. The suffering this could cause, especially to the most vulnerable in society, is almost unimaginable.

Along with rising mortgage rates come people defaulting on their mortgages. This means interest rates rise and banks lose money, diminishing their reserves to lend in the economy, as well as their willingness to lend in the first place.

Finally, the combination of higher mortgage rates and lower profit incentives leads to a decline in house construction. This can be seen in how Persimmon Plc, one of the UK’s biggest housebuilders, is projected to sell between 8,000 and 9,000 houses this year compared to its 15,000 sales in 2022. The impact of this is a lower demand for house-building-related infrastructure, which harms the economy both in the short-run, by decreasing cash flow, and in the long-run, as there is a lack of infrastructure which could have benefitted a multitude of citizens for years to come.

Benefits to the UK Economy

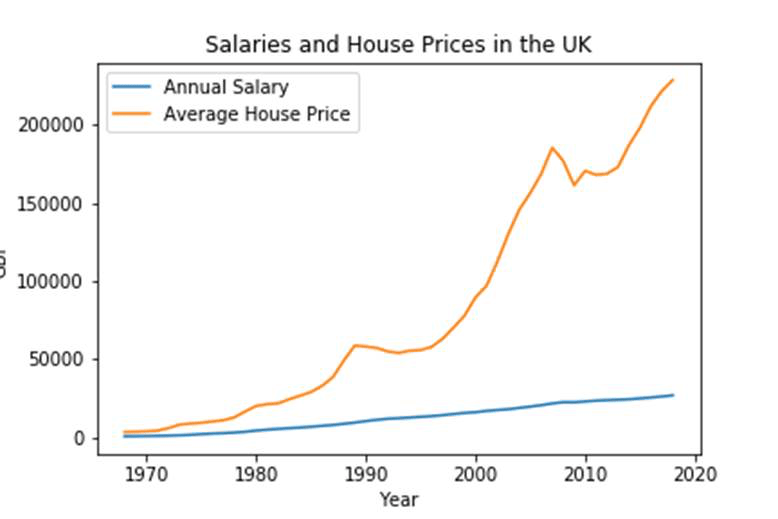

Although it might seem as if only doom and gloom await on the horizon for the average UK homeowner, there is still a silver lining to this potential catastrophe. It is common knowledge that the rate at which house prices have been increasing overshadows the wage increase during that same time. This problematic ratio is glorified in areas such as London, where house prices are astronomical due to the higher population density caused by the availability of high paying jobs. Moreover, the lack of affordable housing leads to a variety of issues, including a shortage of essential public sector workers, a situation which harms local economies. Effects also include how locals are often displaced and forced to live in regions with a lower quality of life, along with how skilled workers are unable to relocate themselves to regions where they can put their talents to good use.

Thus, the crash in house prices could not only solve these issues but also be a boon for first-time buyers, as they now require a smaller deposit, and buying a house becomes a more realistic possibility. Moreover, needing to save less for a deposit frees up the financial resources of these first-time buyers for spending on other goods, hence boosting the economy. Although the housing problems facing London specifically might not be so easily resolved, due to its unique place within the country’s economy, many other regions throughout the nation are in a position to benefit in these ways. This is shown by how London’s house price growth only fell from 6.7% to 4.1% while in areas such as South-West England, the drop was from 12.5% to 4.3%.

Evaluation

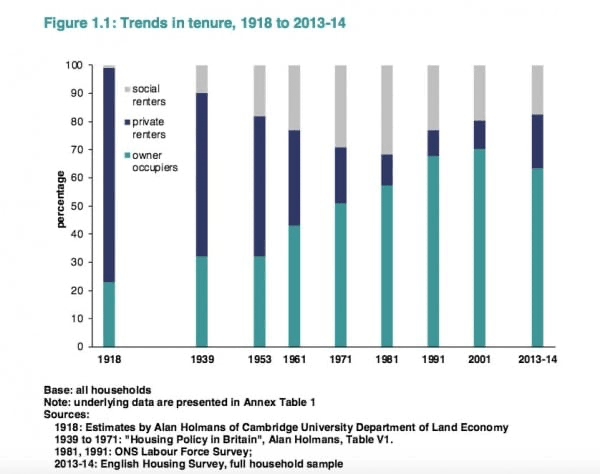

It seems when UK house prices fall further, homeowners will be hurt and future first-time buyers will benefit, but which has a greater impact? The answer becomes clear when the percentage of homeowners is analyzed. Although the number has decreased since its peak in 2001 of 70%, most of the UK population still owns a house, and thus the adversities seem to outweigh any minimal benefits from an economic perspective.

Even the sliver of hope that the cost of renting might decrease along with house prices is dashed to pieces when we discover there is only a very weak correlation between the two. Even in the most obvious example, the financial crash of 2007/08, where house prices fell 25%, the cost of renting fell by a mere 2%, hardly enough to offset the magnitude of the harm the economy suffered. (Economics Help, 2022)

At this point, it seems like we might be witnessing the start of a recession, as can be seen by how short-term interest rates are yielding more than their long-term equivalents, a sign that investors do not have faith in the economy in the long-term. Hence, the best we can hope for is a miraculous U-turn where house prices stop falling as rapidly as they are predicted to. However, this will be determined by other aspects of macroeconomic health; inflation will need to be lower before the Bank of England can stop raising rates, releasing some of the downward pressure on house prices.