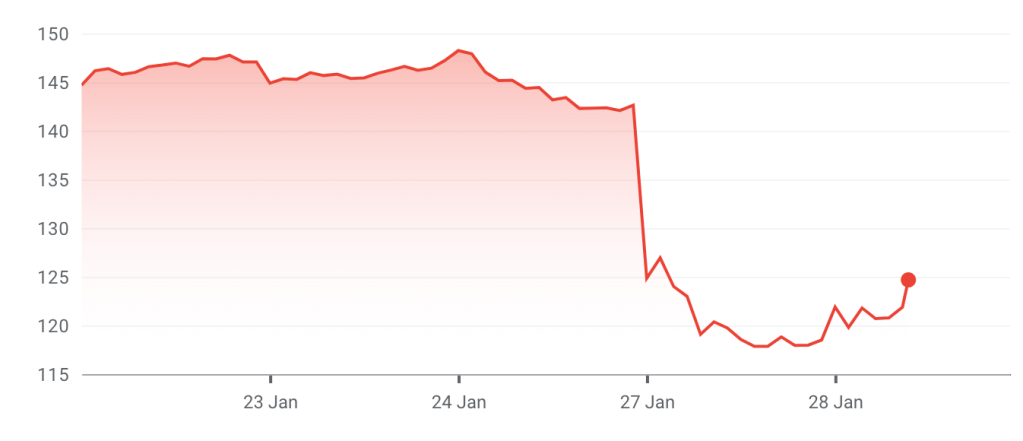

Nvidia’s share price (NVDA) during a five-day period up to January 28th

Source: Google Finance, 2025

On Monday 27th of January, Nvidia (NVDA) suffered a 17% fall in its shares, constituting a $592.7 billion drop in market capitalisation – the total value of company shares held by investors – from $3.5 trillion to $2.9 trillion and corresponding to a fall in share price from $142.62 to $117.95. This was the most catastrophic wipeout in market price recorded up to date, doubling the company’s previous $279 billion loss on September 3rd 2024 which succeeded Meta’s $251 billion loss on February 3rd 2022. This incident consequently dethroned Nvidia’s reputation as the world’s most valuable company, placing it in a disappointing third place behind Apple and Microsoft (which have market capitalisations of $3.36 trillion and $3.23 trillion respectively). The stock plummet also has a collateral impact on tech giants which rely on Nvidia’s chips in their operations: Alphabet’s stock fell by 4%, while Microsoft and Tesla fell more than 2%.

The turmoil in the stock market and fierce reaction from shareholders are predominantly induced by the concern about the impact of the late Chinese artificial intelligence model DeepSeek R1 on the prospect of American-built models as the leader in AI innovation. The model is said to be able to match the capabilities of Western AI models and has already surpassed the performance of OpenAI’s ChatGPT and Anthropic’s Claude-3.5-Sonnet on benchmarks such as MATH-500, AIME, and SWE-bend Verified which assesses the model’s computational and coding abilities. In addition, the recently published paper DeepSeek-R1: Incentivizing Reasoning Capability in LLMs via Reinforcement Learning accentuated the model’s success and prowess in coding and responding to a general, open-ended question – qualities which ChatGPT was praised for upon its initial release. However, the low budget used to build the model urged investors and the general public alike to reconsider the paradigm of artificial intelligence. Until now, the general census was partial to the idea that a large expenditure and high-quality equipment were prerequisites to lead technological innovation. For example, the training of GPT-4 alone was over $100 million, excluding research and operation costs. This in turn has translated into soaring prices such as the Nvidia’s CPU, costing $25000 apiece. Coupled with high demand for high capacity chips, it has become a driving force behind Nvidia’s profit increase from $4.8 billion to approximately $66.7 billion in the span of the two years up to now.

Yet in stark contrast, DeepSeek disclosed that the development of the model only costed $6 million, a mere fraction of that of Western models. Moreover, the model was composed of a store of Nvidia A100 chips, which were acquired before its ban from exports to China in 2022. Experts conjecture that the model was built through a pairing of Nvidia chips with cheaper, less sophisticated ones. This further verifies that it is feasible to build an internationally competitive model – one that can influence the world tech market – with little funding and mediocre equipment. More importantly (and detrimentally), it begins to cast doubt on the US AI industry as to whether it will still be able to maintain the innovation lead in the future; leading AI companies, such as Open AI and Anthropic, may be struggling to justify its high valuation and expenditure: the problem is the return per unit of expenditure, or rather the lack thereof relative to DeepSeek.

The low-cost development of the DeepSeek model shed light on the possibility of a more cost-efficient substitute for Nvidia’s chips, which in turn led to a loss of confidence in the current market; Nvidia’s nebulous growth outlook induces the fear of a stagnating market capitalisation in the face of rising competition from Chinese AI industries. In times of market uncertainty, investors, encouraged by risk aversion and negative sentiment, sell off their shares to secure the unrealised profit bounded by stock. As a result, stock prices – determined by the price mechanism – have plummeted as supply meets falling demand, which is evident in NVDA.