Impact on OPEC of changes in the market for Oil

According to The Organisations of Petroleum Exporting Companies (OPEC), just under 80% of the world’s crude oil reserves are located within OPEC nations. Countries such as China and India rely heavily on OPEC for a steady flow of oil. This has fuelled significant growth in industry and technology seen in these nations over recent years. In theory, inflows of oil to countries should be maximised; however this understandably won’t be the case, primarily due to climate change. The adoption of renewable energy is critical for global sustainability, which presents significant challenges for OPEC. It is imperative that arising changes in demand for oil and subsequent economic issues which are faced by OPEC nations are acknowledged. Understanding the effects of the changes in demand for oil is paramount for OPEC nations so that they can determine how much investment into the crude oil market is needed and how great the demand for the oil is.

How is demand for OPEC oil projected in the next decade?

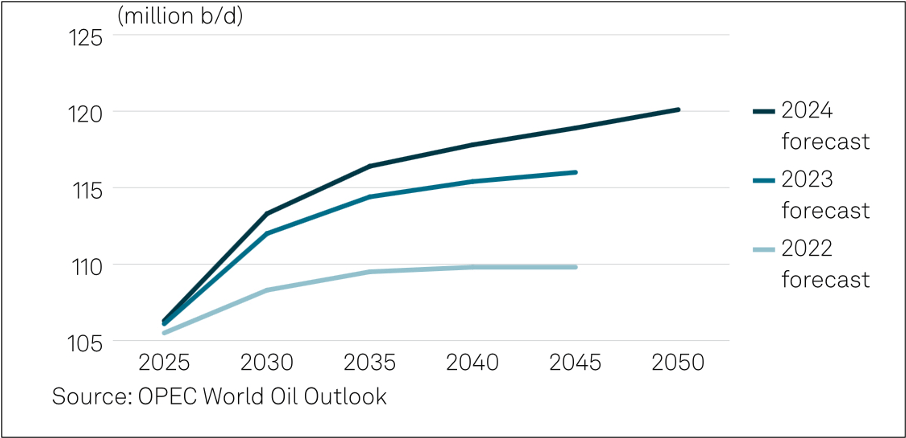

According to OPEC’s world oil outlook, OPEC appears to be raising the estimated oil production (million b/d) curve year after year. The trend is undeniable: all reports show a steady increase in oil production (signalling its increasing demand) but then a reduction in the amount of oil that OPEC produces

The IEA report on oil displayed a very similar estimation, projecting that demand for oil is likely to slow down in this coming decade or so owing to technological advances, government policies and large investments into renewable energy sources.

- However by 2030 OPEC+ crude oil capacity is estimated to rise by 3.5 million barrels per day, suggesting a substantial increase in production capacity to meet the growing demand

- The global shift toward renewable energy and decarbonisation policies will possibly have the most impactful effect on the demand for oil from OPEC countries. By 2050 renewables are projected to grow by over 200% increasing their share in the global energy mix to around 90% while oil’s share declines slightly as a result. In spite of this, global oil demand is still expected to rise to 110 million barrels per day by 2045 due to economic growth and energy needs

However the projected demand changes for OPEC oil may not be as accurate as initially thought. Renewable energy growth is likely to be higher than originally estimated owing to potentially exponential growth in research and development leading to greater use of renewable energy resources. Moreover, while future oil demand projections are relatively accurate, often availability and accessibility of data in lower income countries and newly emerging countries makes precise forecasting difficult. Impacts of supportive policies – such as subsidies into research and development or carbon taxing – suggested in a recent IEA report may also change the projected demands for oil in the future

Growing competition?

The IEA recently projected that global renewable energy capacity will expand by over 5,500 gigawatts by 2030 – three times the increase observed between 2017 and 2023. So although demand for OPEC oil is set to keep rising for the next couple of decades, demand for renewable energy is also expected to increase. In the same report it revealed that China is set to account for almost 60% of all renewable energy capacity installed worldwide between now and 2030. Regarding the progress in the transition to renewable energy, it is encouraging that by 2030 the share of renewables in final energy consumption is forecast to increase to nearly 20% by 2030 up from 13% in 2023. Yet the world is still heavily reliant on fossil fuels and so OPEC is still set to see encouraging numbers in the coming decade, albeit perhaps not as encouraging as they would have hoped.

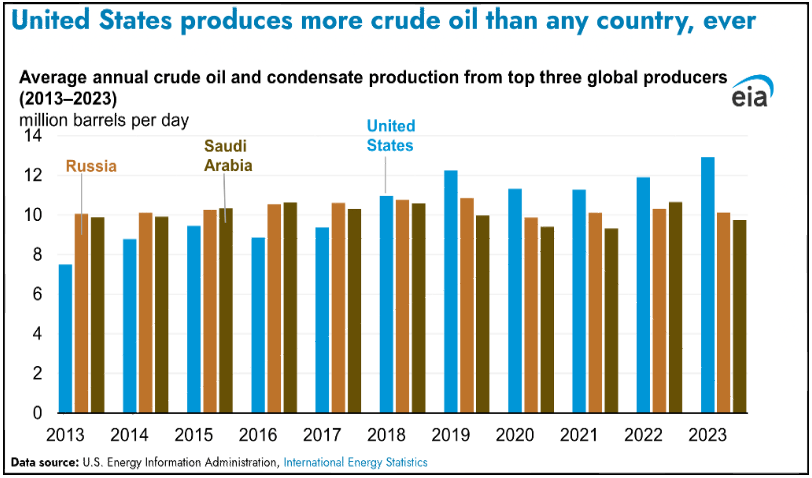

Shown in the EIA report in March 2024 the US produced more crude oil than any other nation for the past six years in a row. One of the main reasons for this was the country’s political and economic security. Countries in the Middle East (some being OPEC countries) have recently become more economically unstable and Russia, has involved itself in a war with Ukraine, redirecting much of its oil supply toward the conflict.

It is imperative for the OPEC nations to understand the future shifts in oil demand. The growing competition in oil production is likely to be one of the major factors affecting OPEC’s output levels. However the increase in anti-oil government policies and the rapid growth of renewable energy sources are the primary concerns for OPEC as they pose the greatest challenge to OPEC’s market dominance.