In early 2021, the stock market experienced one of the most dramatic short squeezes in history, involving the video game retailer GameStop (GME). This event highlighted the power of retail investors, the risks of short selling, and the influence of social media on financial markets. The GameStop short squeeze became a major topic of discussion in the fields of economics and finance, challenging traditional market dynamics.

To comprehend what happened to GameStop, it is important to understand short selling. Short selling is a strategy where investors borrow shares of a stock and sell them at the current market price, hoping to buy them back later at a lower price to make a profit. If the stock price rises instead, short sellers face potentially unlimited losses because they must repurchase the stock at the higher price (which does not ensure a loss cap akin to purchasing a stock) to return the borrowed shares.

In 2020, many hedge funds and institutional investors were convinced that GameStop was a floundering company with a declining business model due to the rise of digital game downloads. They believed that since GameStop was struggling with declining revenues, outdated business models, and store closures, the company’s fall was inevitable. Many funds suspected that a turnaround was unlikely – despite Ryan Cohen’s (Current CEO of GME) late investment involvement – and that the stock price would eventually collapse. Due to Cohen’s strategy being unclear at first, funds thought that it would take years of rebuilding for such a big company like GameStop to turn things around—if it was even possible. They also believe that the stock price was already overvalued, as GME’s stock had climbed from a meager $3-4 from mid-2020 to around $20 in late 2020. They saw this as irrational hype and believed that the stock price belie the company’s dire situation. As a result, they heavily shorted the stock. Hedge funds such as Melvin Capital shorted around 30-40 million shares in a time where the total short float was only 50-60 million, meaning that their position was substantial. However, a group of retail investors, particularly from the Reddit community r/WallStreetBets, noticed the extremely high short interest in GameStop and started buying shares to drive the price up. This led to hedge funds doubling down on shorts, hoping to capitalize on this golden opportunity. Meanwhile, online degenerative traders were desperately holding on to their shares, hoping to raise the price, or to not let it go crashing down. This culminated in a 3000% short squeeze as many shares underwent multiple shorting which collectively constituted 140% of the available shares (70 million shares against the total 50 million).

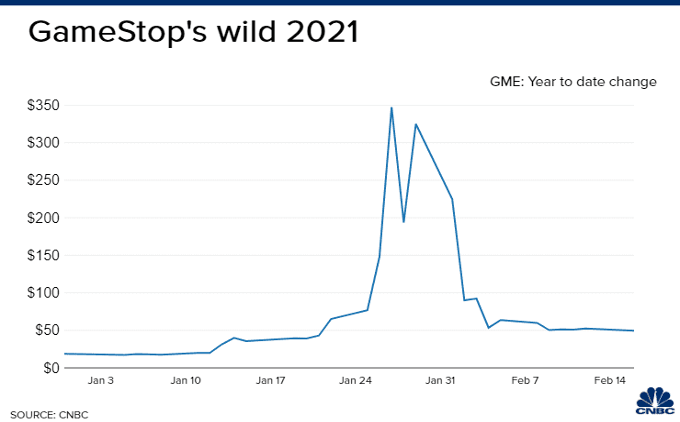

Unlike traditional market movements driven by institutional investors, the GameStop short squeeze was fueled by retail traders who coordinated through social media platforms like Reddit and Twitter. People like Elon Musk also expressed interest in the movement, calling it “Gamestonks!”, and a link to r/WallStreetBets in reference to GME, the subreddit and the term“stonks”, a meme rising in popularity at that time[R1] . These investors were motivated not only by potential profits but also by a desire to challenge Wall Street hedge funds that they believed had manipulated markets for years. As more people bought GameStop shares, the price skyrocketed from under $20 in early January 2021 to an all-time high of over $500 in pre-market value by January 28, 2021, and $350 in market value according to CNBC. The graph clearly shows the two peaks GME achieved before going back to its original shape. The price rose by 30 times since the beginning of the month, when the stock was valued at just a meager $17.25. Its overall value was now worth more than 20% of the global gaming industry’s entire value.

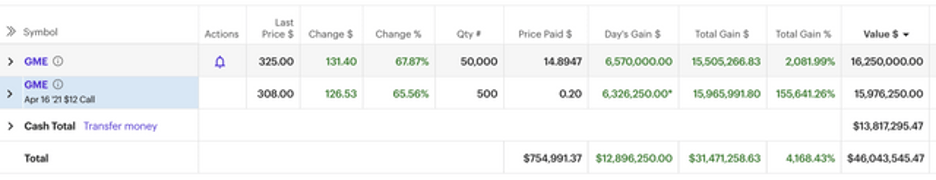

The GameStop short squeeze demonstrated the power of collective retail investing and the risks of excessive short selling. Some hedge funds, like Melvin Capital, suffered massive losses, while some retail investors (also known to Wall Street as “degenerative online YOLO traders”) made significant gains. Reports suggest that Melvin Capital lost around 53% of its assets in January 2021, reportedly down over $6.8 billion due to its heavy short position. They amassed a $2.75 billion bailout from their investors Citadel and Point72 to survive. This eventually caused Melvin Capital’s dramatic shutdown in 2022 due to losses and investor withdrawals. Meanwhile, some individual investors like Keith Gill (known under the alias “Roaring Kitty” on YouTube) made roughly $45 million by the end of January by holding onto their GameStop shares. The chart below shows his trades, with single day gains as large as $6.5 million from its market value of $325. However, the event also ignited concerns about market volatility and the role of trading platforms. This eventually led the brokerage app Robinhood to temporarily restrict trading on GameStop and cite liquidity issues, which sparked debates about fairness and transparency in financial markets. The U.S. Congress even held hearings in February 2021 to investigate the actions of hedge funds, trading platforms, and market regulators. They called in Keith Gill, who then made the infamous comment, “In short, I like the stock.”

Additionally, data from S3 Partners shows that short sellers lost an estimated $5 billion in January 2021 alone due to the rapid increase in GameStop’s stock price. This massive financial shift demonstrated the risks of overleveraged short positions and forced hedge funds to reconsider their strategies.

GameStop’s 2021 short squeeze was a historic moment in financial history that showcased the impact of retail investors, the dangers of excessive short selling, and the growing influence of social media in stock trading. While the long-term effects of this event are still debated, it highlighted the evolving nature of financial markets and raised questions about regulation and market fairness. This phenomenon will likely never happen again, cementing itself as one of most significant moments in Wall Street trading history.