Note: This article was written in March/April 2025, when the initial set of tariffs had been proposed.

Trump’s Tariffs: Short-Term Protection or Long-Term Economic Risk?

Introduction

On November 5th, 2024, Donald Trump was re-elected as President of the United States, triggering wide-spread impacts for the global economy. Almost immediately, he resumed his previous trade war with China and launched new tariff-based confrontations on Canada and Mexico. Tariffs are essentially taxes on the imported goods that make the goods more expensive in the importing country; governments often use them to protect local industries or to retaliate against trading partners (as they can choose which countries to put tariffs on). However, these measures can also carry broader economic consequences. This article will explore how Trump’s new tariffs affect both the U.S. and the global economy.

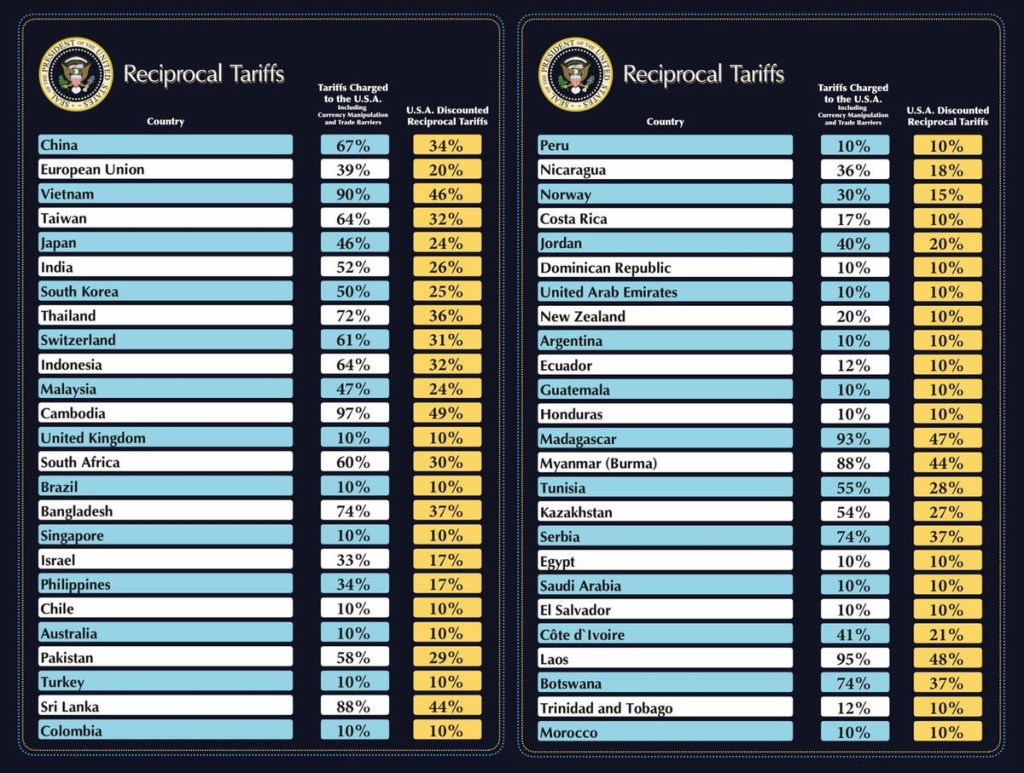

Figure 1: Proposed reciprocal tariffs plan, published in April 2025 by the Trump Administration

Trump’s New Tariffs Explained

Trump’s latest trade policies represent an expansion of his protectionist agenda. On March 4th, 2025, he imposed a hefty 25% tariff on imports from Mexico and Canada and doubled the tariff on Chinese goods from 10% to 20%. In addition, a large 25% tariff was applied to steel and aluminium products from all countries. Several other industries—including automobiles, pharmaceuticals, and tech—were also impacted by these trade tariffs. These sweeping tariffs mark a strategic attempt to revive domestic manufacturing and reduce dependency on foreign supplies.

Impact on the U.S. Economy

These tariffs are bound to have a significant impact on the US economy, whether it be by raising consumer prices or increasing the rate of inflation.

1. Higher Consumer Prices

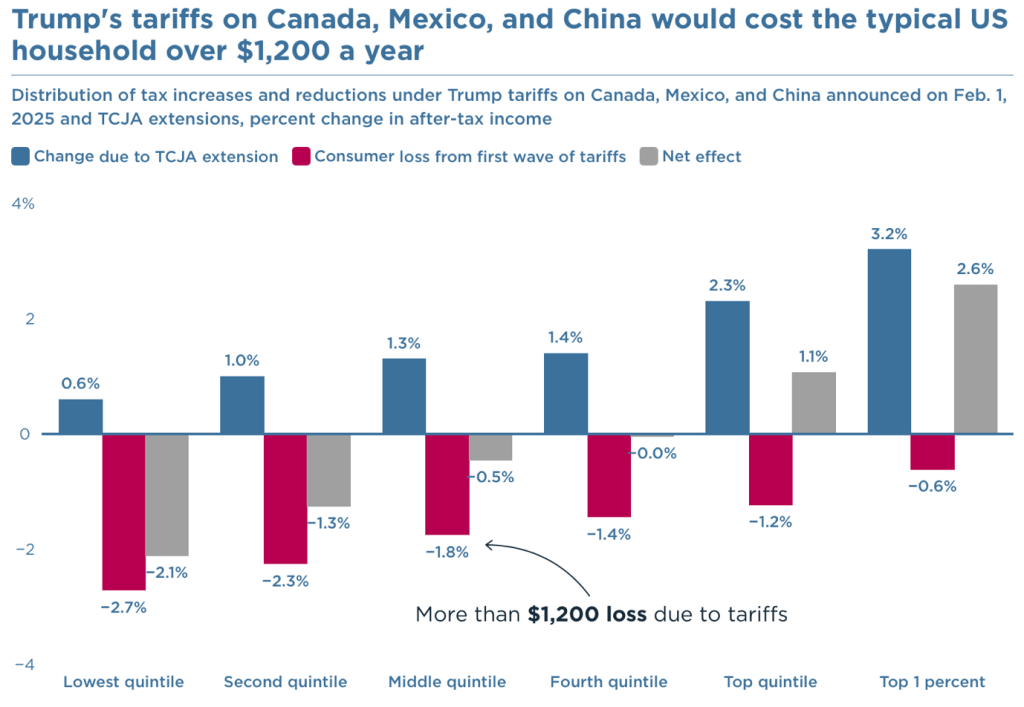

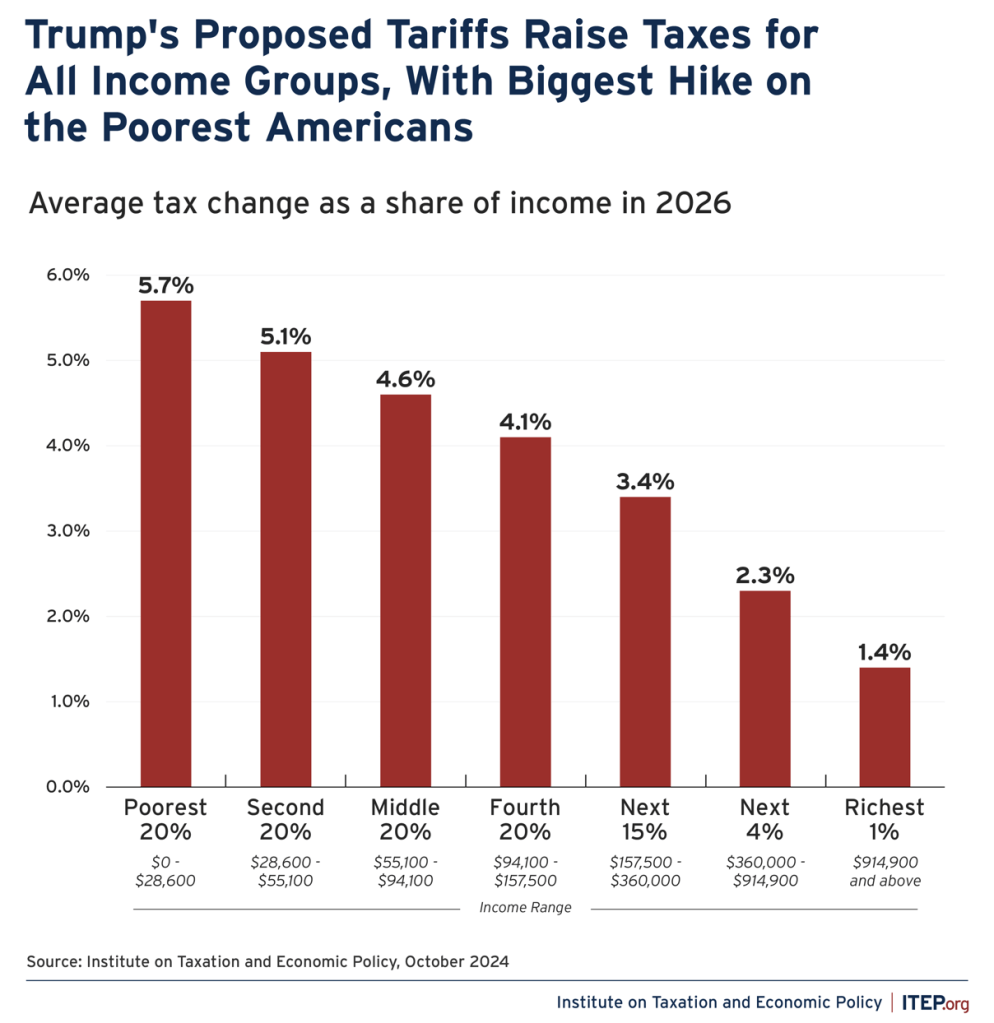

Tariffs increase the cost of imported goods, and these costs are often passed on to consumers. As shown by figure 2, the average American family may spend up to $1,200 more per year due to these tariffs. This is a result of American households having to face higher prices on everyday products. Figure 3 shows how this burden is especially heavy on low- and middle-income households already struggling with the rising cost of living and a tight budget.

Figure 2:

Figure 3:

2. Disruption for Businesses

Many U.S. businesses rely on imported materials and components, particularly in sectors such as automobile manufacturing and construction. With tariffs raising the cost of key inputs like steel, firms have higher production costs and are forced to either absorb the higher expenses by reducing their profit margins or raise prices, potentially losing competitiveness and making less sales. On the other hand, however, some domestic producers may benefit from reduced foreign competition, at least in the short term.

However, retaliatory tariffs from trading partners have hurt American exporters, especially in agriculture and aerospace. An example is seen during Trump’s previous tariff battles in his first term, when trading partners hit back with retaliatory tariffs (after he imposed tariffs on steel and aluminium in 2018). This led to US farmers experiencing significant declines in overseas sales and requiring government aid. However, in 2018, domestic steelmakers were doing very well and credited it to the tariffs.

3. Inflation and Slower Growth

Tariff-induced price rises inevitably contribute to inflationary pressure. As consumers and businesses adjust their spending to accommodate higher costs, overall economic activity and spending may decline. Lower consumption and investment could lessen innovation and slow down long-term growth, which, in the long run, tends to harm low-middle class families, since innovation can make everyday products more affordable.

Impact on the Global Economy

1. Retaliatory Measures and Trade Tensions

Trump’s tariff policies, such as the tariffs against Canada and China, have provoked strong responses from U.S. trading partners. For example, Canada imposed 25% tariffs on $30 billion worth of American goods, targeting iconic products such as peanut butter, bourbon whiskey, and motorcycles. Meanwhile, China introduced export restrictions on key goods headed for the U.S. These back-and-forth actions further escalate tensions and make it harder for businesses to trade freely.

2. Supply Chain Shifts

Firms that once sourced materials or components from other countries are now seeking alternative suppliers to avoid having to pay increased tariffs. Reconfiguring supply chains can be costly and disruptive, leading to delays in production and delivery. In the short term, this can reduce global efficiency and affect economic output.

3. Market Uncertainty and Investment Risk

The announcement of new tariffs has introduced significant uncertainty into financial markets. Stock markets generally fall when major tariff changes are revealed, reflecting fears of a global economic slowdown. Trump’s recent tariffs triggered a worldwide sell-off in equities, and currencies of trade-sensitive nations like Canada and Mexico depreciated as a result.

4. Long-Term Economic Risks

These trade tensions arise at a time when the global economy is still recovering from the COVID-19 pandemic and other geopolitical challenges. If protectionist measures continue, global economic growth could stagnate. Additionally, a prolonged trade war may push economies reliant on exports into a recession. However, on the other hand, countries not directly involved in the disputes may find opportunities to expand their market share and to capitalise on that.

Historical Parallels

Trump’s trade policies draw comparisons with past tariff battles, notably the 2018–2019 trade war during Trump’s first presidency and the infamous Smoot-Hawley Tariff Act of 1930, where, in June 17 1930, the U.S legislation raised already high tariff rates to protect American farmers and businesses. Although it originated in the US, it negatively impacted almost everywhere in the world and worsened the Great Depression. During the previous Trump administration, American consumers and importers bore the most of the costs, while U.S. farmers required government assistance to stay afloat due to less exports. These examples are historical lessons which suggest that tariffs often produce more unintended economic harm than good.

Conclusion

Trump’s new tariffs mark a change in U.S. trade policy, with a ripple effect that extends across the globe. While they may offer short-term protection for domestic industries, they also result in higher consumer prices, potential inflation, strained international relations, and disrupted supply chains. Historical evidence casts doubt on the effectiveness of such measures, and a warning of greater economic pain than benefit. Ultimately, while tariffs can be a strategic tool for economic protection, their overuse may trigger a lose-lose scenario for the whole world. Whether these new policies will lead to future prosperity or deepen global economic struggles remains to be seen.

nice

LikeLike

good

LikeLike

Well analysed article!!

LikeLike